Local woman continues to fight property tax bills

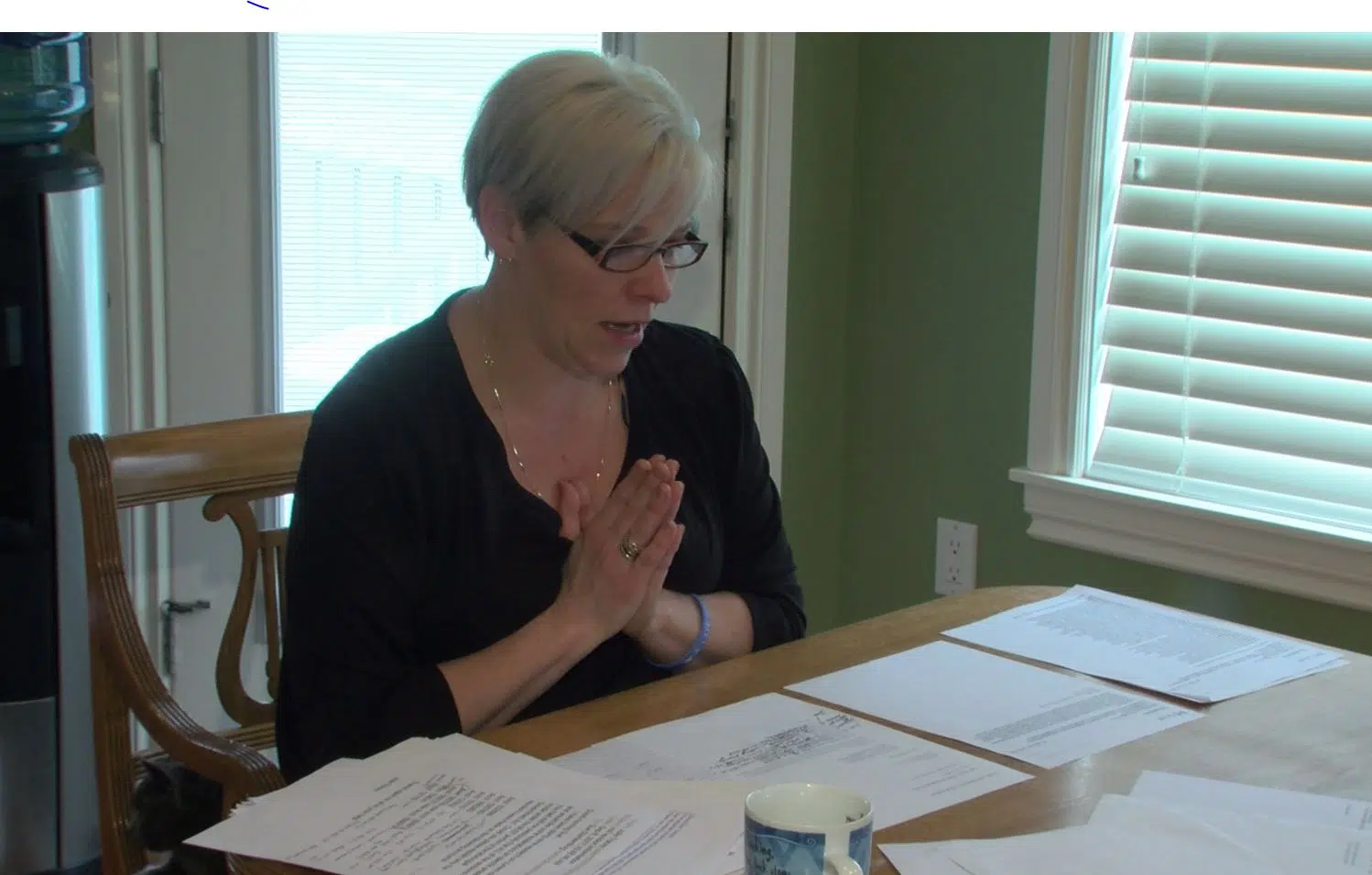

MEDICINE HAT, AB — A local woman is demanding more action from city hall after councillors voted not to correct her property tax bills.

She believes she has proof that the city has corrected issues in the past, but feels like they’re refusing to listen to her.

Julie Tracey opened her property tax assessment in July and saw her taxes were going up more than $200 a month.