Local woman’s property tax increases due to assessment error

MEDICINE HAT, AB — A local woman is paying for an assumption made by the city.

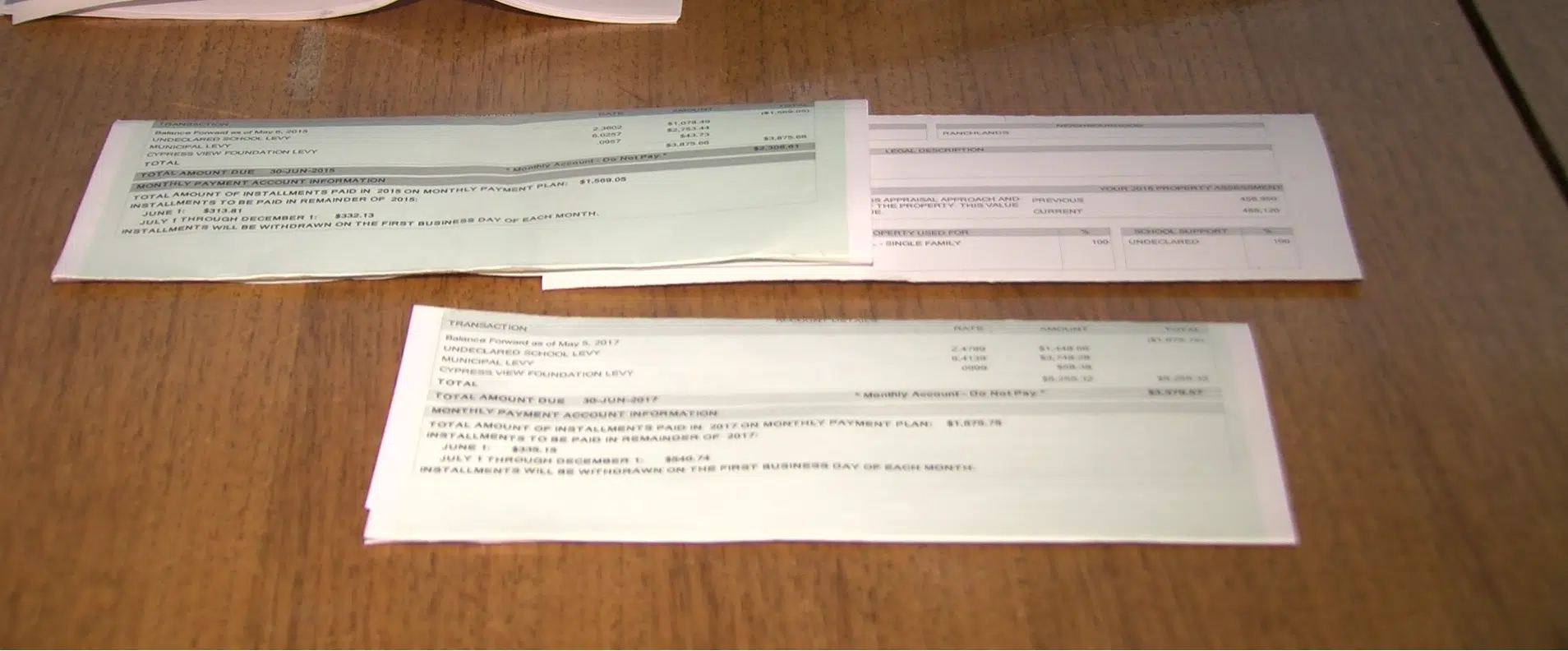

When Julie Tracey opened her property tax assessment Monday, she noticed that she now is going to pay $205.69 more every month because the value of her home increased $120,000.

Tracey thought that was interesting because no adjustments were made to her house. Confused, she called the city and was told that, due to a reclassification of her deck and the renovations made to her basement and garage, her property value went up.