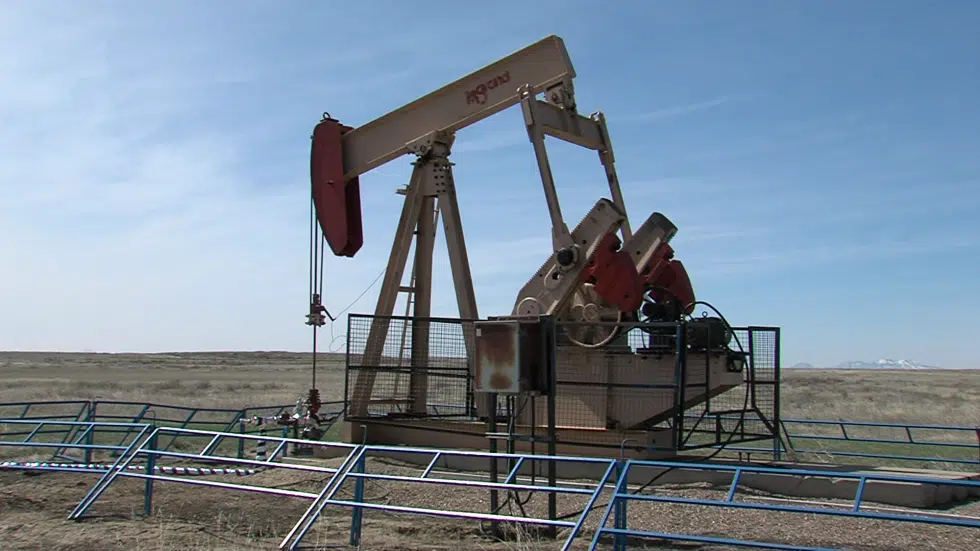

Calgary-based junior oil and gas company shuts down

CALGARY, AB — A Calgary-based oil company announced they are shutting down.

Trident Exploration Corp. officially ceased operations on Tuesday, according to a release on the company’s website. The decision affects 33 employees and 61 contractors.

In the release, the privately-held company says “the combination of extremely low natural gas prices and high surface lease and property tax payments (totaling $0.72 C$/GJ) has exhausted the liquidity of the company.” The company is also blaming capacity constraints on TransCanada Corp.’s NGTL pipeline system.

“Further, and despite our extensive efforts, Alberta has no mechanism to allow a struggling energy company such as Trident to address its inflated surface lease and property tax obligations,” the release reads.