Deadline for most taxes is tomorrow

MEDICINE HAT, AB – It’s the end of April and that means you may be busy crunching numbers, as income tax returns are due tomorrow.

If you owe Revenue Canada, filing on time helps you avoid interest and additional penalties.

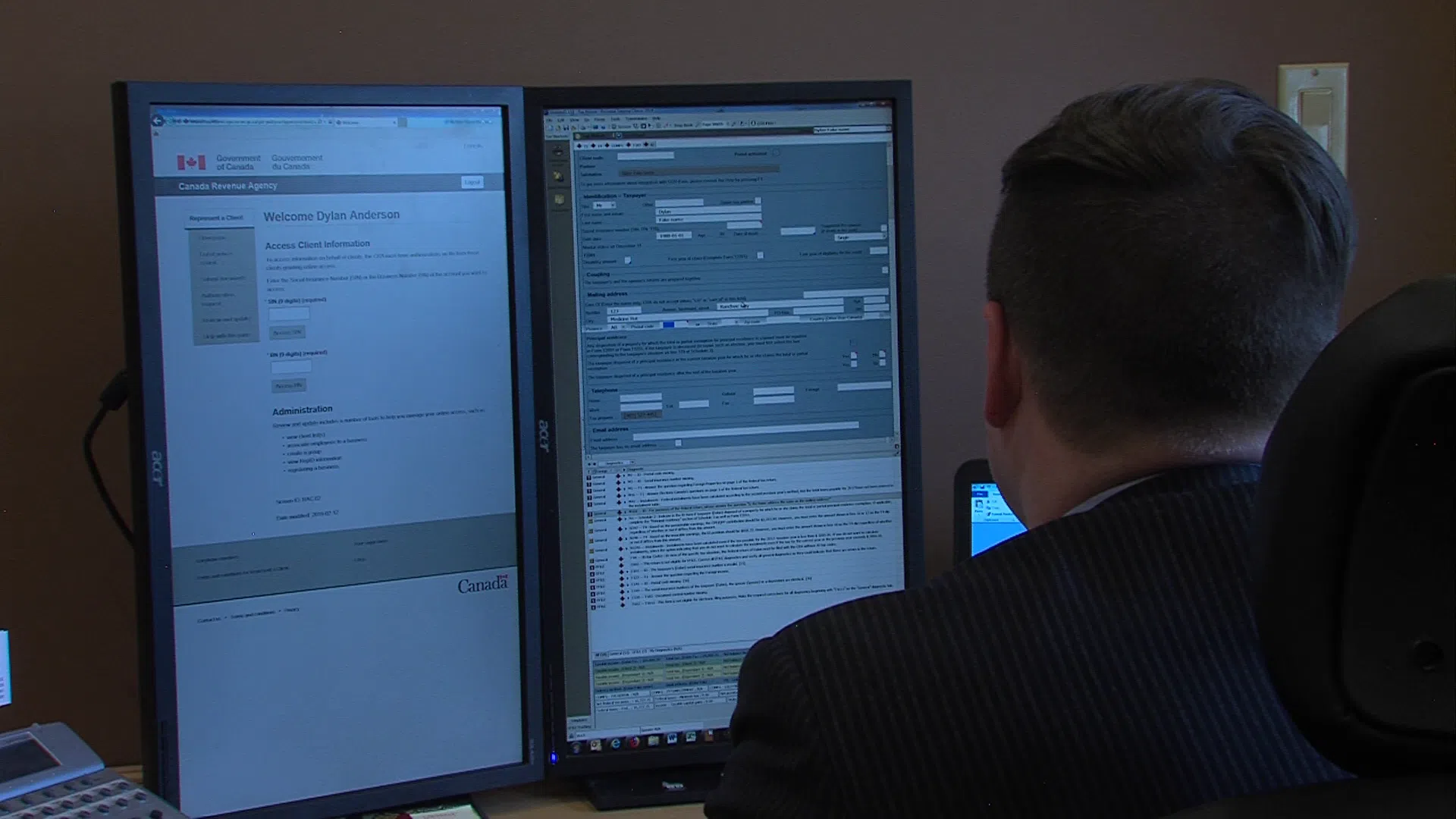

Accountant Dylan Anderson says there are a number of options to pay outstanding balances.