Provincial tax relief program to cost Cypress County millions

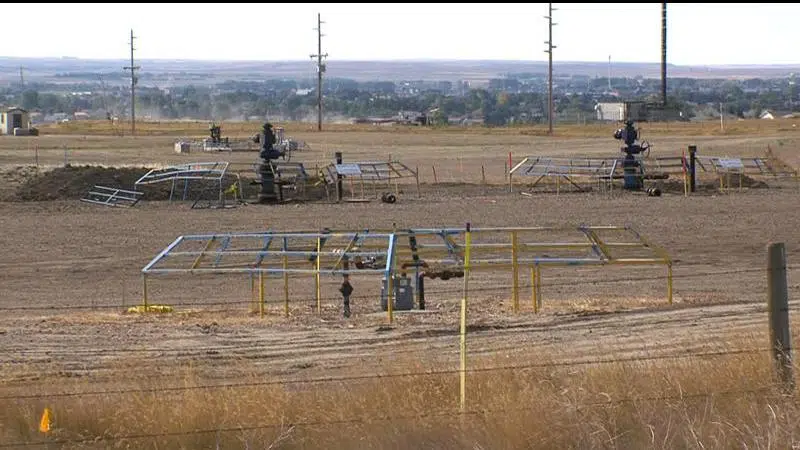

Medicine Hat, AB – The move by the province to cut tax assessments on shallow gas wells will likely cost Cypress County $3 million dollars in 2020.

The province announced last month a move which extended tax relief to shallow gas producers through 2020. However, while the 15 rural municipalities affected received a rebate from the province for the same cut last year, they won’t be this year.

The provincial decision will have an oversized impact on Cypress County which has about 30 per cent of Alberta’s 70,000 wells and pipeline properties affected but, due to having already one of the lowest assessment rates, only collects eight per cent of the tax revenue on shallow gas wells province wide.